Does Afterpay Affect Credit Score? Trick Insights for Liable Loaning

Does Afterpay Affect Credit Score? Trick Insights for Liable Loaning

Blog Article

Examining Whether Afterpay Use Can Impact Your Debt Rating

As the appeal of Afterpay continues to rise, several people are left questioning regarding the prospective effect this service might have on their credit history. The correlation in between Afterpay usage and credit report is a subject of rate of interest for those intending to preserve or improve their economic health and wellness. By exploring the subtleties of how Afterpay transactions are viewed in the eyes of credit rating bureaus, we can begin to unravel the complexities of this modern-day payment method's impact on one's creditworthiness. Allow's look into the details of this connection and reveal the crucial aspects at play.

Understanding Afterpay's Influence on Credit history

While Afterpay does not perform credit scores checks when consumers at first sign up, late or missed out on payments can still impact credit rating scores. When a customer misses a payment, Afterpay may report this to credit scores bureaus, leading to an unfavorable mark on the individual's credit record. Monitoring payment due days, keeping a good payment background, and making sure all installments are paid on time are critical steps in securing one's credit rating rating when utilizing Afterpay.

Aspects That Impact Credit Report Changes

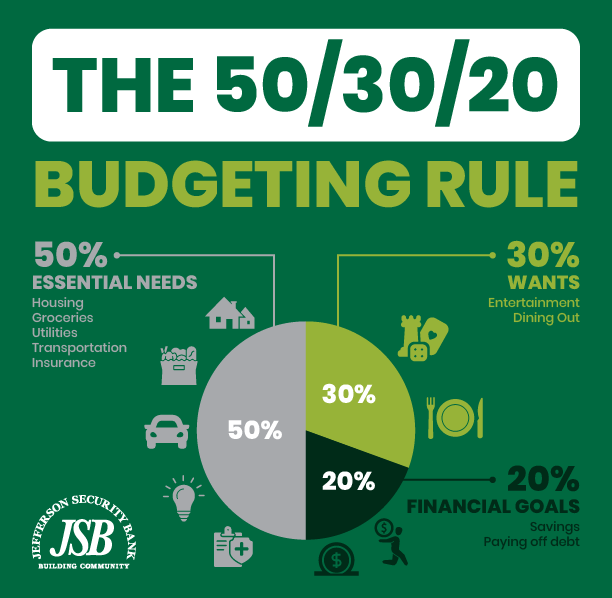

Comprehending Afterpay's effect on credit report reveals a direct link to the different variables that can significantly influence modifications in a person's credit history in time. One crucial element is repayment background, representing concerning 35% of a credit history. Making on-time payments regularly, including those for Afterpay purchases, can positively impact the credit rating. Credit report application, that makes up about 30% of ball game, is an additional essential variable. Making use of Afterpay sensibly without maxing out the available credit score can aid keep a healthy and balanced credit score application proportion. The length of credit rating, contributing around 15% to the score, is likewise vital. Using Afterpay over an extended duration can favorably impact this aspect. In addition, brand-new credit report inquiries and the mix of charge account can influence credit history. does afterpay affect credit score. Although Afterpay might not directly influence these aspects, understanding their importance can help individuals make educated decisions to keep or enhance their credit rating while making use of services like Afterpay.

Tracking Debt Score Modifications With Afterpay

Monitoring credit report changes with Afterpay includes tracking the influence of settlement practices and credit score application on overall credit history wellness. By using Afterpay properly, individuals can preserve or enhance their credit report. Prompt settlements are critical, as missed out on or late payments can negatively affect credit rating. Checking settlement due days and making certain enough funds are readily available to cover Afterpay installations can aid prevent any adverse influence on credit rating. In addition, maintaining debt application reduced is necessary. Using Afterpay for tiny, convenient purchases and keeping bank card equilibriums reduced relative to credit rating limitations demonstrates liable debt habits and can his comment is here favorably affect credit report. Regularly reviewing credit history records to inspect for any type of mistakes or inconsistencies associated to Afterpay purchases is likewise recommended. By remaining alert and proactive in monitoring settlement practices and credit scores application, individuals can properly manage their credit history while making use of Afterpay as a repayment alternative.

Tips to Handle Afterpay Responsibly

To navigate Afterpay responsibly and maintain a healthy credit history, individuals can apply reliable approaches to handle their financial obligations wisely. Firstly, it is crucial to create a spending plan laying out revenue and costs to guarantee affordability before devoting to Afterpay purchases. This method assists prevent overspending and accumulating financial debt over one's head's ways. Secondly, making use of Afterpay precisely for vital products rather than indulgent acquisitions can help in maintaining financial security. Prioritizing settlements for requirements can avoid unneeded monetary strain and advertise accountable spending behaviors. Furthermore, keeping track of Afterpay settlement schedules and ensuring prompt payments can aid stay clear of late charges and adverse effect on credit history. Consistently keeping an eye on Afterpay transactions and general financial health and wellness via budgeting applications or spreadsheets can give important understandings into costs patterns and help in making informed economic decisions. By complying with these pointers, individuals can utilize Afterpay responsibly while guarding their credit report and financial wellness.

Verdict: Afterpay's Role in Credit scores Health And Wellness

In analyzing Afterpay's impact on credit history health and wellness, it comes to be noticeable that sensible economic monitoring continues to be extremely important for people using this service. While Afterpay itself does not straight impact credit rating, forgeting settlements can bring about late costs and financial obligation build-up, which might indirectly affect creditworthiness - does afterpay affect credit score. It is crucial for Afterpay users to budget effectively and ensure prompt settlements to maintain a positive credit history standing

Furthermore, understanding how Afterpay incorporates with individual finance habits is vital. By making use of Afterpay properly, individuals can enjoy the ease of staggered check my blog repayments without jeopardizing their credit history health. Monitoring investing, examining affordability, and remaining within budget plan are fundamental techniques to avoid financial pressure and potential credit history implications.

Final Thought

Recognizing Afterpay's influence on credit scores exposes a direct link to the different aspects that can substantially affect adjustments in a person's debt rating over time. In addition, brand-new credit rating inquiries and the mix of credit history accounts can affect credit scores.Keeping track of credit scores score changes with Afterpay involves tracking the influence of settlement behaviors and debt application on total credit score wellness - does afterpay affect credit score. Utilizing Afterpay for little, workable purchases and keeping credit history card balances low loved one to credit restrictions shows responsible credit rating actions and can favorably affect credit score scores. By staying proactive and vigilant in checking repayment habits and debt use, individuals can successfully manage their debt score while using Afterpay as a settlement option

Report this page